A Call to Arms for the Insurance Industry – the War for Talent in a Digital Age

The real competitive advantage in any business is one word only, which is “people”

– Kamil Toume, Writer & Thought Leader

Even before COVID, the world was undergoing a profound shift in human capital management, with business leaders working to address skills gaps, update their talent practices and instil more dynamic and agile ways of working. Since the pandemic, there is a worldwide shortage of talent, especially for people with digital skills. Whilst the insurance industry has quickly adjusted to remote working and online collaboration, insurers are being outfought in the battle to attract talent (e.g. Facebook/Meta and Google will hire 60% of UK data scientists in 2021-23 with median salaries of £80,000).

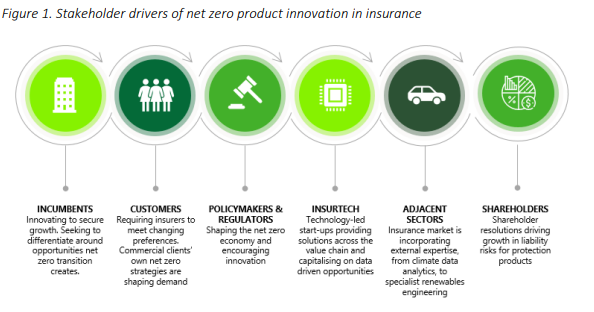

We are living in an era of the 3 Ds: De-carbonisation; Digital Transformation and Diversity. For the insurance industry there is the extra pressures of Open Insurance/Embedded Insurance, new disruptive InsurTechs. The result is insurers need to rapidly optimise their human capital management strategies.

But this message is not getting through to the C-suite within the insurance industry. In a 2022 EY survey of CEOs, only 5% of insurance CEOs said people and talent were a top priority for change in the next 3 years, compared to 26% of all CEOs across all industries.

Insurers need to attract new streams of talent, strengthen their corporate cultures, and enhance employee experience if they are to succeed when facing new challenges and changes in the mid 2020s.

The foot soldiers in insurance are no longer actuaries and underwriters but come with new job titles such as data scientists, digital business analysts, cloud specialists, experience designers, solution architects and scrum masters.

As a starting point, insurance firms need to communicate more on being a force for good transformation agenda. Insurance is entering a massively exciting period of change and innovation. Very few other industries can offer this.

At the high level, insurers need to break the mould that insurance is an industry that is slow-moving, dull, and only actuaries have career prospects. So, what next? Insurers need to spread the following messages:

1. Insurance is a force for good

The underlying raison d’etre of the insurance industry remains incredibly positive – protecting people and building a better world. Insurance firms need to be much more affirmative with this message to attract the Gen-Z/millennial workforce.

2. A chance to shine

Insurance in the mid-2020s offers huge opportunities for innovation and transformation. Few other industries can offer talent the means to be part of digital transformation projects that give them the ability to showcase their skills and be part of a dynamic ecosystem. Good insurance firms have an optimal mix of combination of the following:

- Embracing modern technology

- Strong existing distribution channels

- Existing in-house expertise of underwriters and actuaries

- Vast amounts of reliable historical data

The insurance industry is in a unique position to offer the chance to build skills and work on game-changing projects in a digital age.

3. Working on the important stuff – climate change

Climate change is a huge risk for the insurance industry but also a huge opportunity. Insurers are active participants in solutions to climate change on the macro and micro level. Firstly, insurance firms have the means to provide big investments in infrastructure that respond to climate change. Secondly, insurers are major influencers on consumer behaviour in changing people’s awareness and attitudes to risks associated with climate change.

Nigel Wilson, CEO of Legal & General, is on record as saying “climate change is the biggest investment opportunity in the world […] with the UK having the chance to become a leader in offshore wind power […] carbon capture, hydrogen, onshore wind, solar, retrofitting 20 to 25 million houses. This all adds up to a trillion-pound industry creating tens of thousands of jobs.”

Developing innovative new products and solutions to protect against climate risks and leading the shift to a greener economy will help elevate insurers’ reputation among younger workers and encourage green behaviours.

The message to talent pools is that insurance is an industry where you can make a difference, be innovative and have a positive impact on society. The direction to insurers is that this message needs to be louder.

The second part of this blog (coming soon) will be for the insurance firms, giving specifics of what Hanover is seeing in best practice hiring tactics by insurers to engage and nurture people with the skills to thrive in the digital transformation of the insurance industry.

Further Reading:

https://www.cisl.cam.ac.uk/files/climatewise_climate_product_innovation.pdf

https://www.nasdaq.com/articles/why-latin-americas-insurtech-revolution-is-just-getting-started

https://theundercoverrecruiter.com/data-driven-talent-acquisition/