What Tenure Trends Reveal About Your Talent Strategy

When I speak to clients across financial services, one challenge keeps coming up: retention. It’s not just about hiring great people. It’s about keeping them long enough to deliver real impact. Turn-over is to be expected, but how long should we really expect people to stay?

That’s what made me dig into the data. I wanted to understand how long people have been with their current employer and what that says about the state of the workforce across Europe, the US and Asia. Using open-source LinkedIn data, I mapped tenure patterns across thousands of these financial services professionals.

What I found surprised me. Not just in the numbers themselves, but in what they reveal about the pressures businesses are facing, from high attrition in Europe to legacy leadership risks in the States. The trends uncovered offer clear lessons for talent leaders trying to future-proof their organisations.

Europe FS: A high churn environment, or the aftermath of aggressive hiring?

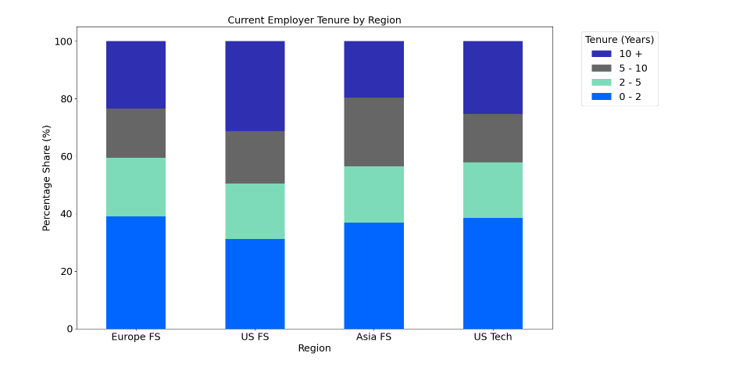

Europe’s FS workforce is the most fluid of the three markets I analysed: 39% of professionals have been in their roles for just two years or less, the highest share across all regions (chart 1).

It might reflect ambitious hiring in recent years, but it also raises questions about retention and how hard organisations are fighting to keep their high performers. With so much talent still in the early stages of onboarding, firms must ask:

- Are we supporting people beyond day one?

- Do we have clear progression paths in place?

- Is our learning and development (L&D) strategy built for new joiners, or legacy staff?

The data also shows that this isn’t just early-career movement. Even among those with 10-15 years’ industry experience, over 40% have joined their current employer in the last two years (chart 2). That mid-career cohort is the pillar of operational stability and leadership continuity. If they’re constantly in motion, it disrupts everything from succession planning to strategic execution.

US FS: Stable today, vulnerable tomorrow

The US FS sector is more stable, even conservative, than its fast-paced media reputation suggests. Only 31% of its workforce has been in their current role for under two years, and another 31% have been in their jobs for over a decade, the highest long-tenure share of any region.

This has upsides: institutional knowledge, long-standing leadership continuity, deeply embedded client relationships. But it also carries risks. A heavily tenured workforce without regular refreshment slows innovation, especially if there’s insufficient mid-career hiring or internal mobility.

For firms operating in the US market, the challenge isn’t retention but succession. Organisations must urgently plan for leadership transitions before retirements and resignations create gaps that are hard to fill.

Asia FS: Strong mid-career retention, but long-term continuity is less certain

Asia’s financial services workforce shows a unique shape. With the highest concentration of 5–10-year tenure (24%), there’s the suggestion of successful mid-career retention, likely reflecting rapid growth in regional financial hubs and a talent market still maturing.

But it also flags a potential weak spot. Just 20% of Asia FS professionals have stayed with their employer for more than a decade, on par with Europe and well below the US. As these markets continue to mature, building long-term loyalty will become more critical.

What this all means for recruitment and retention strategy

These tenure patterns aren’t just descriptive, they’re directional, giving us clear cues on what talent leaders need to prioritise.

With Europe’s high-turnover talent base, firms must be prioritising L&D, onboarding and progression opportunities. Otherwise, churn will remain high and ROI on recruitment will fall.

In the US, long tenure is an asset, but also a ticking clock. Succession planning and structured mid-career hiring are key to avoiding leadership gaps as experienced professionals move on.

And in Asia, investment in leadership development will be the crucial lever that shifts 5–10-year tenure into true organisational legacy.

The take-away is that tenure isn’t just about how long someone has stayed. It’s a signal of how well an organisation has delivered on its promise, and how much potential it’s got sitting under the surface.

Contact me directly or reach out to the wider team if you’d like to discuss this topic in more detail.